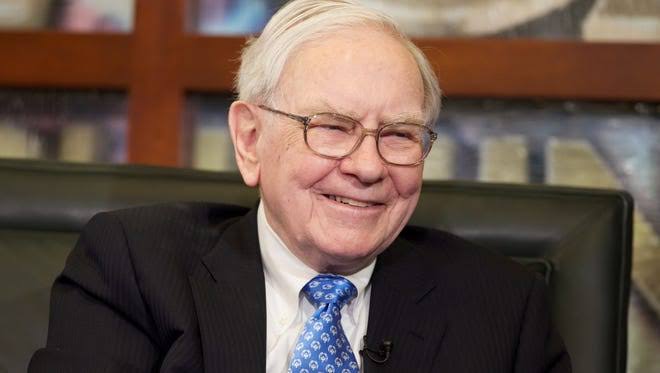

Omaha, December 31, 2025: Warren Buffett steps down as chief executive officer of Berkshire Hathaway on December 31, bringing to a close nearly 60 years of leadership that turned a struggling textile business into one of the world’s most influential conglomerates. Greg Abel will assume the role of CEO, marking a carefully planned transition at the top of the company long guided by the man known globally as the “Oracle of Omaha.”

Buffett began buying shares of Berkshire Hathaway in the early 1960s at a modest price, eventually reshaping the company into a diversified powerhouse spanning insurance, manufacturing, retail, energy and transportation. Over decades, Berkshire consistently outperformed the broader market as Buffett focused on long-term value investing and disciplined capital allocation. Even after donating more than $60 billion to philanthropic causes, Buffett’s Berkshire holdings are estimated to be worth around $150 billion, according to the Associated Press.

Under his stewardship, Berkshire acquired major insurance firms such as Geico and National Indemnity, expanded into manufacturing through companies like Iscar Metalworking, and built a strong consumer presence with brands including Dairy Queen. The group also made landmark infrastructure investments, notably in BNSF Railway, while generating substantial returns from long-term stakes in companies such as American Express, Coca-Cola and Apple.

In recent years, Berkshire’s massive scale has made it more difficult to replicate its earlier growth rates. Identifying acquisitions large enough to significantly boost earnings has become increasingly challenging, and even recent multi-billion-dollar deals are unlikely to dramatically alter the company’s financial trajectory. As Abel takes charge, investors will be watching closely for any changes in strategy or capital deployment.

Buffett will remain chairman of Berkshire Hathaway and is expected to stay actively involved, continuing to work from the office and offering advice on investments when needed. Abel, who has overseen all non-insurance operations since 2018, is seen as a steady choice to ensure continuity during the transition.

The succession plan has been in place for several years. In 2021, Buffett’s longtime business partner Charlie Munger publicly endorsed Abel as the future leader, assuring shareholders that the company’s culture would remain intact. While Abel is regarded as a more hands-on executive, he is expected to maintain Berkshire’s long-standing philosophy of granting autonomy to subsidiary leaders as long as performance targets are met.

Earlier this month, Abel announced senior management changes following the departure of Geico CEO Todd Combs and the retirement of Chief Financial Officer Marc Hamburg. He also appointed NetJets CEO Adam Johnson to oversee Berkshire’s consumer, service and retail businesses, creating a new organisational layer while retaining direct control over manufacturing, utilities and railroad operations.

As Buffett relinquishes the CEO role, Berkshire Hathaway enters a new chapter shaped by a successor groomed to uphold the principles that defined its rise, even as one of the most remarkable leadership eras in corporate history draws to a close.