Vancouver (Richa Walia): In a move to strengthen British Columbia’s position as a hub for interactive digital media, the provincial government has announced a significant increase in tax incentives for developers of video games, virtual reality simulators, and related technologies.

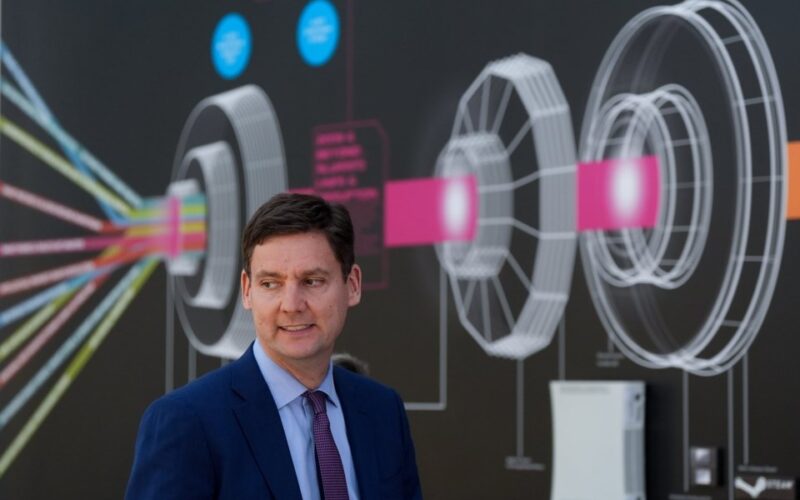

Premier David Eby revealed that starting September 1, the Interactive Digital Media Tax Credit will rise from 17.5% to 25%, providing additional support for companies like Electronic Arts and others operating in B.C. The credit, which was previously temporary, will also be made permanent, giving long-term financial clarity to businesses in the sector.

“This is about future-proofing British Columbia’s economy,” said Eby. “The recent U.S. tariff threats were a wake-up call. We need an economy that isn’t vulnerable to external pressures, and investing in digital media is one way we build that independence.”

Finance Minister Brenda Bailey added that the enhanced credit is a strategic move to grow B.C.’s knowledge economy and maintain its appeal to global talent. “While other provinces offer even higher tax incentives, B.C. has a strong competitive edge thanks to our overall tax system and quality of life. A 25% rate strikes the right balance,” Bailey noted.

Creative BC, the government agency overseeing the province’s cultural industries, estimates that the interactive digital media sector—including video games, virtual and augmented reality, and educational software, employs around 20,000 people and contributes more than $1 billion annually to B.C.’s economy.

With this boost, B.C. aims to solidify its standing as a leader in the rapidly evolving world of digital innovation and creative tech.